New Mileage Rate...With a Twist

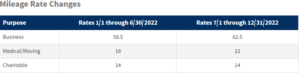

The IRS recently announced that, beginning July 1st, the mileage rates for business travel, as well as deductible medical/moving travel has increased 4 cents to $0.625 and $0.22 per mile respectively. (Charitable miles remains the same at $0.14 per mile) The "twist" to this is the mileage recorded for the first 6 months of the year will be $0.585 ($0.18 medical/moving) per mile, and the second 6 months will be $0.625 ($0.22 medical/moving) per mile.Make certain you are dating your mileage log, and updating your mileage tracking apps, to reduce the confusion and headache at the end of the year!

Child Tax & Dependent Care Credit

If this applies to you, you probably have already seen the payments deposited into your account each month on the 15th. The government has made a one-time increase to the child tax credit to $3,000 per child (up from $2,000), or $3,600 for children 5 and under. Where do those payments come into play? The purpose was to get money into the taxpayers’ hands “immediately”. Therefore, they have been depositing $250-300 per child each month as an advanced credit, with the rest of the credit being paid out when the tax return is filed.

There are a few instances where this may affect some taxpayers in a different way. If your income has changed over the previous year, you may not receive the second half of the credit figured on your tax return. If a taxpayer had a child during the 2021 calendar year, you wouldn’t receive advanced payments for this child. Therefore, you would receive the full credit on your tax return. If there is a situation with alternating years’ custody between divorced parents, this becomes more complicated and probably requires special handling.

The IRS was instructed to create an online portal to give taxpayers an opportunity to update information including:

- Add/Change bank account information

- Unenroll from these advanced payments (receive full amount on tax return)

- Update your modified gross income

They were also instructed to give taxpayers an option to add/change dependent information, to add the new child and amend shared custody situations. Unfortunately, the IRS hasn’t completed this and will not by the end of the year. Use this link to check your payment status and history, as well as access the options mentioned above.

February Update

STIMULUS PAYMENTS & CHARITABLE CONTRIBUTION DEDUCTION

We wrote and attached to our website in November what is new with your taxes this year. Now, after two weeks talking with clients as they prepare to send us their info, or discuss omitted items, we think it is time to refresh some points made in the November posting. This will be our first edit to our November post, probably with more to come. If you have a question after reading the post, we welcome your inquiry-it may become the basis for another edit.

Stimulus Payments

There is a lot of misinformation circulating about how these will be treated in your return. (misinformation- how did it evolve into the popular press term “fact checks”?) When preparing your return, you are required to enter the amount received from your stimulus payment(s), including the one received in late December, early January. If you did not receive one or both of the payments, and based on the income parameters you should have, the shortfall will be added to your refund. Likewise, if your income was reduced, and you fit the income parameters in 2020 but not 2019, the amount owed will be added to your refund; or reduce the amount of tax owed for the year. If the IRS sent too much, whether it is because you earned more in 2019, had an extra dependent, or just made a mistake, they cannot take the money back! Nor will it reduce the refund they owe you,

How will they know if the amount you provide is correct? The same way they know if your child’s SS# is correct or if a dependent has already been claimed this tax season. If you provide them with the incorrect amount, and in-turn they overpay your refund, you can expect a letter in 6-18 months in a white envelope-we know how you love to receive those. And the computer is well trained to follow-up until the matter is resolved.

$300 Charitable Contribution Deduction

There is also confusion about the $300 per return allowance for charitable contributions. (This will be increased in 2021 to $300 per individual allowed) You are allowed to deduct this on the front of the return, even if you are unable to itemize. BUT, it is for a donation paid in cash-not clothing dropped off at the Goodwill drop box /store. It does not qualify for treats you bought for kids at church for which you have a receipt. You will receive a letter from the charity for your CASH donation-they are required to provide a written receipt for all donations more than $250 from a single donor. You cannot trust that copy of your cancelled check taken from your bank statement will be accepted. You can, however, make your case for it qualifying if you have cancelled checks less than $250 to each charity that total up to $300. Cash in the collection plate at church must be receipted-the only way to accomplish this is to use the church envelopes so the church secretary/treasurer knows who the offering is from and can tally those offerings at year end. If you do not have it this year, there are no do overs-just remember to change your offering to a check or cash in an envelope in 2021. And a check to the Girl Scouts is still for cookies-not qualified.

To date, these are the only questions that have arisen that require further clarification. However, return to this site frequently to see additions as we see the issues arise dealing with clients this tax season. We will also be posting the dirty dozen (scams highlighted by the IRS being made on taxpayers and/or Scams uncovered by the IRS processing tax returns).